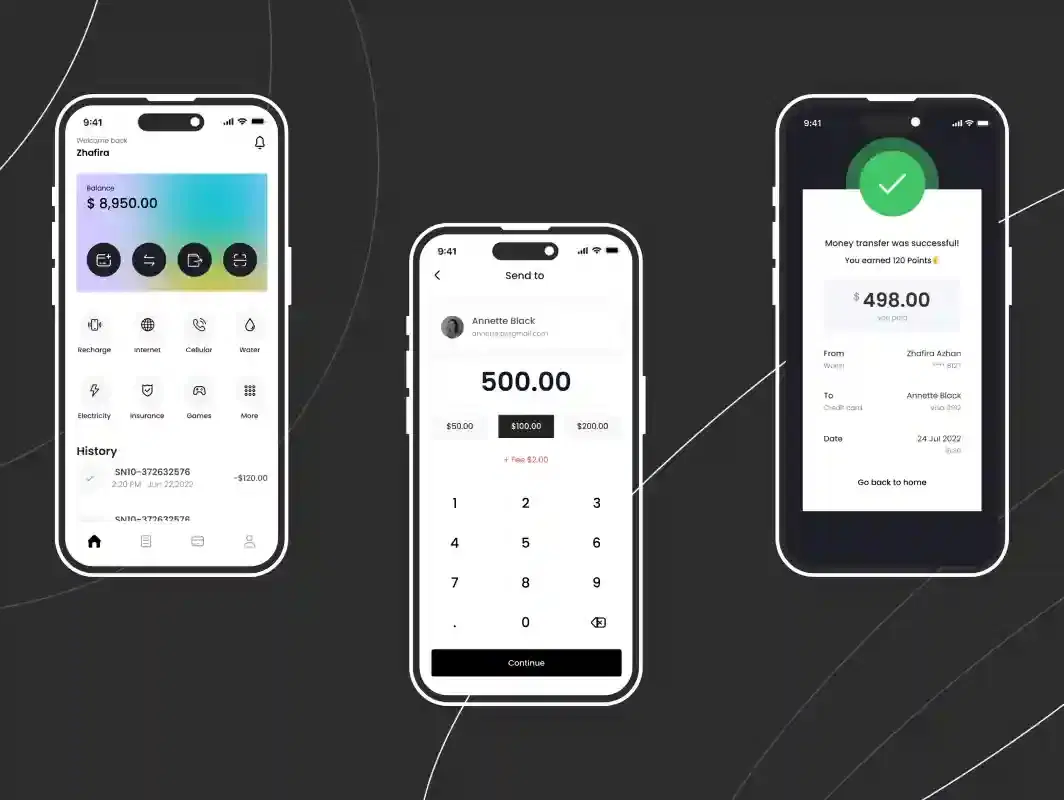

Predictive Behavior & Risk Scoring Engine

Uses machine learning to forecast churn, credit risk, or demand surges based on historical behavior, enabling timely interventions and strategic business decisions

Key features

Assess user behavior and risks with predictive scoring engines that provide insights, reduce exposure, and enable proactive decision-making:

Risk Scoring

Assign accurate risk scores using predictive analytics

Evaluate risks effectively with AI-driven models that generate accurate scores for users and transactions

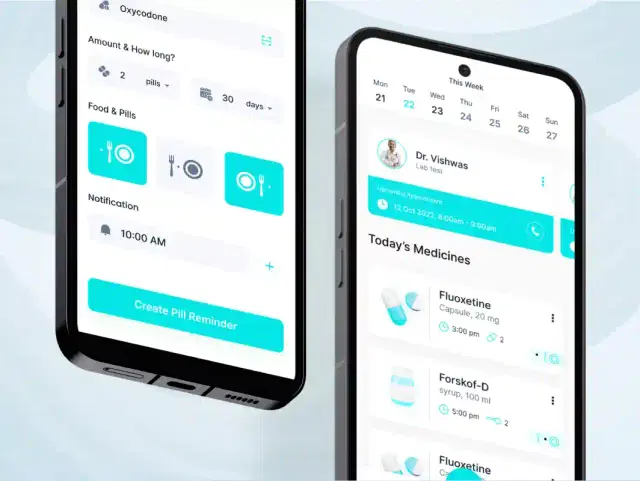

Behavior Tracking

Track user behavior for actionable risk insights

Monitor user behavior continuously to detect anomalies, reduce risk exposure, and improve decision-making

Fraud Detection

Detect fraudulent activity using AI-powered models

Prevent losses by detecting suspicious activities and fraud patterns early with predictive machine learning

Real-Time Alerts

Trigger instant alerts on suspicious activity

Notify security teams immediately with real-time alerts whenever unusual or risky activity is detected

Adaptive Models

Continuously improve risk scoring through learning

Improve reliability as models learn and adapt with new data, making scoring more accurate and dynamic

Compliance Ready

Align risk scoring with global compliance frameworks

Ensure risk scoring meets international compliance standards and regulatory requirements across industries